Related Insights

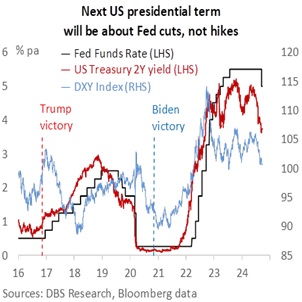

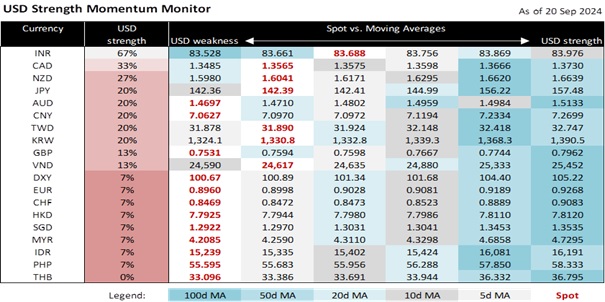

We have lowered our forecasts for the USD and US interest rates. Barring shocks to the global economy and financial markets, we see the DXY Index resuming its depreciation into a lower 95-100 range through 2025 on the Fed’s rate-cutting cycle. This follows over 20 months of consolidation in a 100-107 range under the Fed’s “high for longer” rates stance.

On September 18, the US Federal Reserve reduced the upper bound of the Fed Funds Rate (FFR) range with a significant 50 bps cut to 5%. Based on our expectation for US GDP growth to become less exceptional at 1.7% in 2025 vs. 2.3% this year, we project a further cumulative 200 bps reduction in the FFR to 3% in 2025, a notable revision from our previous projection of 4%. This Friday’s US PCE deflators should validate Fed Governor Christopher Waller’s concern about inflation running softer than anticipated. Fed officials speaking this week will reaffirm the commitment to avert a further cooling in the US economy and labour market. The return of a positive US Treasury yield curve (10Y vs. 2Y spread) should weigh on the greenback with its steepening bias.

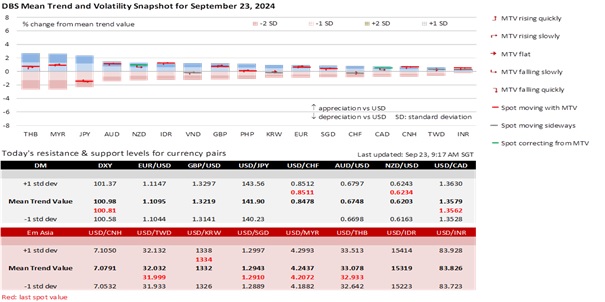

Conversely, the European Central Bank and the Bank of England did not lower their guard against inflation, showing little willingness to match the Fed’s pace of rate cuts. With their bond yield differentials leaning against the US, EUR/USD and GBP/USD have been supported above their psychological levels of 1.10 and 1.30, respectively, after mid-August. AUD/USD is also likely to hold above 0.68 on positive bond yield differentials, assuming the Reserve Bank of Australia defers rate cuts to 2025 at tomorrow’s meeting.

On September 26, the Swiss National Bank should lower rates a third time by 25 bps to 1%. Last week, the Swiss State Secretariat (SECO) for Economic Affairs forecast CPI inflation decelerating to 0.7% in 2025 from 1.2% in 2024, aligning with the SNB’s view that a strong CHF was curbing imported inflation and hurting Swiss exporters amid weak demand from Europe. However, USD/CHF may not break above its four-week range of 0.8400-0.8550. CFTC data suggested that its fall has been driven by an unwinding of short CHF positions, reflecting aggressive Fed cut expectations.

We do not expect the US Presidential elections on November 5 to support the greenback. Former President Trump’s popularity has diminished, with Vice President Harris gaining favour after their presidential debate on September 10. Unlike 2017 and 2021, the next presidential term, beginning in 2025, will coincide with Fed cuts rather than rate hikes. Additionally, the ballooning US federal debt over the last two presidencies will constrain the incoming administration’s economic policies.

Quote of the day

“Republics decline into democracies and democracies degenerate into despotisms.”

Aristotle

September 23 in history

In 1970, IBM announced the first computer to employ semiconductors for its main memory.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.