Related Insights

- Guarded against excessive SGD optimism 07 Jan 2026

- SGD Rates: Bifurcation to reverse 07 Jan 2026

- India markets: Yield upmove reflect pricing reset 06 Jan 2026

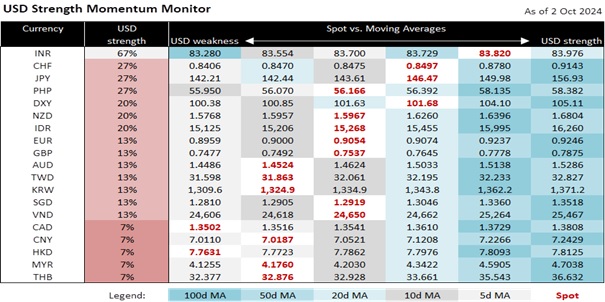

The USD’s outlook is sensitive to the Fed’s data-dependent rate-cutting outlook. The DXY Index appreciated by 0.4% to 101.62 on the better-than-expected jobs data. The Automatic Data Processing (ADP) Research Institute reported that the private sector added 143k jobs in September, beating the 125k consensus. August was revised to 103k from 99k. However, the ADP institute noted that stronger hiring was not accompanied by stronger pay growth. Today, pay close attention to the ISM Services PMI employment index, which consensus expects to moderate to 50 in September from 50.2 in August on lacklustre activities. ISM Manufacturing employment fell to 43.9 in September, near its 4-year low of 43.4 in July. Initial jobless claims will also be important given its (4-week moving average) decline to 225k from a high of 241k since early August. While consensus sees Friday’s nonfarm payrolls rising to 150k in September, falling claims suggest a possible upward revision in August data from 142k.

Richmond Fed President Thomas Barkin’s comments did not push the DXY above the 101.69 high hit after the ADP data. Echoing Fed Chair Jerome Powell, Barkin explained that the Fed’s 50 bps cut in September was not a response to a troubled US economy but a recalibration to a less restrictive monetary stance. Since the final hike to 5.25-5.50% in July 2023, US inflation declined closer to the 2% target amid a cooling labour market. Barkin was not ready to declare victory on inflation; he did not expect 12-month core inflation to drop much further until 2025. Although the unemployment rate increased to 4.2%, it remained near most estimates of its natural rate. Heeding the corrective nature of the Fed’s narrative, the futures market is no longer looking for another 50 bps but a 25 bps cut at the FOMC meeting on November 7.

USD/JPY’s tone is firm after rising 2% to 146.47, its highest close since the start of September. Japan’s new Prime Minister Shigeru Ishiba said the conditions were not right for more interest rate hikes following the two increases earlier this year. Economy Minister Ryosei Akazawa said the new administration’s top priority was ensuring Japan completely exited from deflation. During his meeting with the prime minister, Bank of Japan Governor Kazuo Ueda assured that the central bank will be cautious in its commitment to normalize monetary policy i.e., hiking again only if the economy and inflation meet the BOJ’s forecasts. The OIS market expects the BOJ to keep the target rate unchanged at 0.25% for the rest of the year.

With the BOJ seen going slow on hikes and the Fed slow on rate cuts, USD/JPY likely returned into a higher 145-150 range ahead of the BOJ meeting on October 31. Interest may return to JPY carry trades, especially AUD/JPY, which closed above the psychological 100 level for the first time since end-July. However, AUD/JPY still needs to overcome a major resistance at 101.40 or its 100-day moving average.

Quote of the day

“Most of the energy of political work is devoted to correcting the effects of mismanagement of government.”

Milton Friedman

October 3 in history

In 1997, Japan's maglev train broke world speed record for a manned train.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- Guarded against excessive SGD optimism 07 Jan 2026

- SGD Rates: Bifurcation to reverse 07 Jan 2026

- India markets: Yield upmove reflect pricing reset 06 Jan 2026

Related Insights

- Guarded against excessive SGD optimism 07 Jan 2026

- SGD Rates: Bifurcation to reverse 07 Jan 2026

- India markets: Yield upmove reflect pricing reset 06 Jan 2026