- DeepSeek has taken the world by storm, challenging OpenAI’s long-headed AI dominance

- DeepSeek’s achievements only serve to further the AI narrative

- Increased spending and continued innovation will continue to drive AI growth

- US Big Tech continues to be in pole position as DeepSeek grapples with reliability issues

- Stay invested in AI through the DBS I.D.E.A strategy to ensure diversified exposure

Related Insights

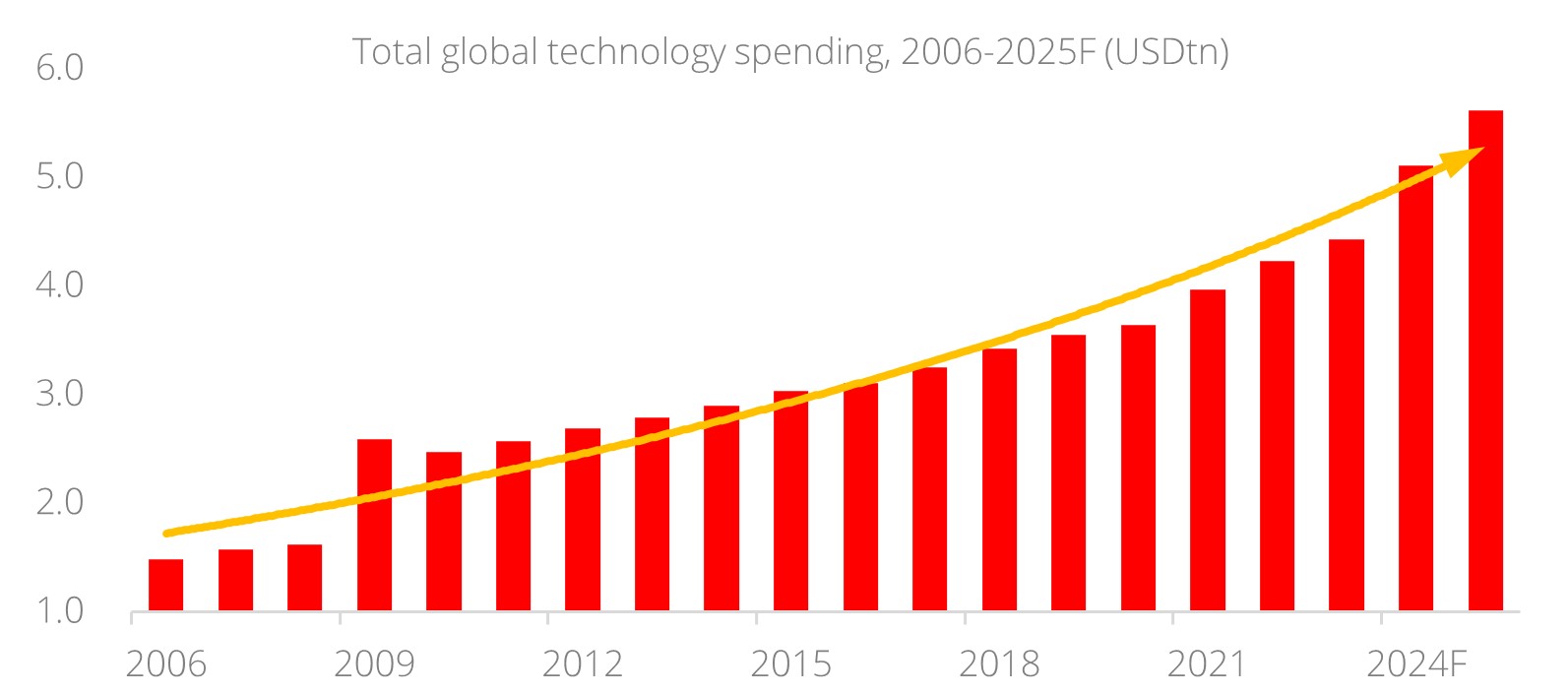

US Big Tech still in the driver’s seat. On that same note, we have to acknowledge that while DeepSeek does pose a challenge to US Big Tech, the latter remains firmly in pole position. Alternative strategies for AI development and commercialisation, such as prioritising efficiency, may emerge with DeepSeek’s successes, but it does not change the fact that the vast majority of AI development still relies squarely on advanced GPUs as its hardware backbone. Microsoft and Meta will release their results this week, and their projected capital expenditures are expected to surpass current market expectations — USD80bn/year for Microsoft and USD60-65bn/year for Meta. It is also anticipated that US-based cloud service providers (CSPs) will increase spending on inference optimisation. This will inevitably lead to a decrease in per-unit costs for AI over time. Examining the current charging models of OpenAI and Google Gemini, their advantages lie in system stability, which supports consistent enterprise output and drives significant B2B user subscription growth. With American CSPs continuing to expand capital expenditures, a portion will likely be allocated to enhancing service stability and supporting power supply, while further global data centre expansion will ensure more reliable system support. Overall, we remain bullish on US Big Tech, driven by a strong total addressable market and positive outlook on global technology spending.

Source: Bloomberg, Gartner, DBS

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")