- Local Bitcoin peaks arrive within 1-1.5 years of halving, making 2025 a closely watched year

- Trump's pro-crypto stance supports a bullish narrative, but we believe it warrants further thought

- Ethereum continues to underperform Bitcoin due to the dearth of DeFi activity

- Investors should remain disciplined, paying attention to more fundamental tailwinds...

- ...related to liquidity and money supply for Bitcoin, rather than headlines on presidential policy

Related Insights

- Korea Equities: Growth, Reform, and Resilience12 Dec 2025

- Korea Equities: Growth, Reform, and Resilience12 Dec 2025

- US Equities 1Q26 | The Return to Quality11 Dec 2025

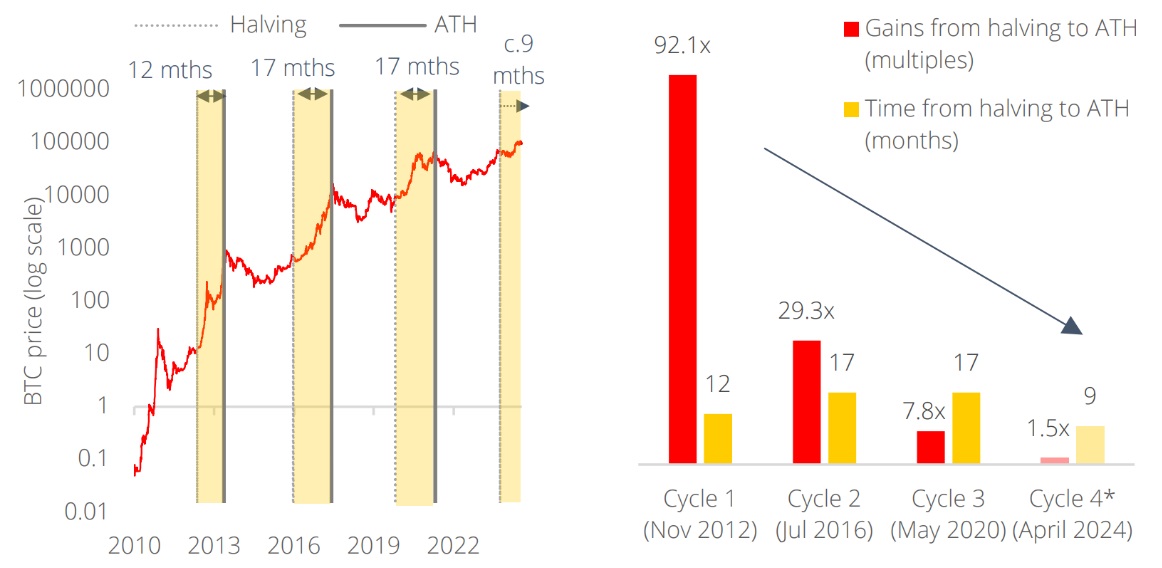

A time to sow, a time to reap. Cyclicality is such a common human experience that it can be found in everything from markets to mother nature. One cannot help but wonder if Satoshi Nakamoto – Bitcoin’s famed pseudonymous inventor – had cycles in mind when designing the halving mechanism to occur with seasonal regularity every four years or so. While crypto bulls strategise around this catalyst for great gain, there would eventually be a time where the bears start to sniff about for signs of fragility amid exuberance. Notably, over the last three cycles, the local all-time highs (ATH) tend to arrive within 12-17 months after the halving date. If history repeats itself, we will know what this ATH is by the end of 2025.

Figure 1: Local Bitcoin peaks arrive within 1-1.5 years of halving, making 2025 a closely watched year for profit-taking

*Performance so far, assuming peak has not yet been reached.

Source: Bloomberg, DBS

“Wen moon sky?” Muddying the picture is the fact that each subsequent ATH is a sequentially lower multiple on its price at halving, pouring cold water on more aggressive profit-taking levels. Like every other maturing market, one should not expect gains to be in the magnitude of those experienced by early adopters. That, however, will not stop traders from trying to time their exits as close to the ATH as possible, seeing as bullish momentum has continued to persist after Donald Trump’s election victory.

Trump redux. Speaking of President Trump, the markets have decided that after the 2024 (a) halving and (b) SEC approval of spot Bitcoin ETFs, his presidential policies are the next best pond to fish for catalysts that would take prices another leg upward. He is after all the first openly pro-crypto president in US history, appointing a “crypto czar” within his administration and making plans for a “Strategic Bitcoin Reserve”. Uncannily, the trajectory of Bitcoin prices in the fourth halving has thus far charted a very similar course to the path in 2016 – the year he was previously elected. From a technical standpoint however, we view such policies as less dependable catalysts compared to those in 2024, after a several considerations.

Our doubts revolve around the “strategic” and “reserve” descriptors in “strategic Bitcoin reserve”. Firstly, is it truly “strategic” to have a Bitcoin reserve? Strategic reserves are meant to stockpile critical resources that can be tapped on in times of crisis; the best-known example being the US Strategic Petroleum Reserve (SPR) created by congress in 1975 after the Arab oil embargo. Even Canada has a strategic maple syrup reserve and China a reserve of metals and grains, but these can be considered critical consumables for survival, characteristics that would be a stretch to attribute to Bitcoin. Proponents have argued that this stockpile of Bitcoin “assets” could appreciate rapidly enough to allow the US to reduce its debt liabilities, but this implicitly means a large devaluation of the dollar against Bitcoin, signaling low confidence in their own currency at a time when other countries are also weaning themselves off the greenback. Sacrificing the exorbitant privilege of having the world’s reserve currency does not seem “strategic” in our book.

Secondly, the US presently only has around 200,000 Bitcoin (c.USD21b at current market prices) obtained through seizure via law enforcement; hardly enough to constitute a “reserve”. Increasing this reserve requires surpluses; only available to countries that have savings in the likes of sovereign wealth funds, one that the US lacks but which president Trump is trying to create. Rather than sovereign wealth, the US runs a “Sovereign Debt Fund” – called the Federal Reserve – which buys Treasury debt in eye-watering amounts to ensure smooth market functioning; it would perhaps be a while before they have the savings to accumulate Bitcoin (to say the least). The next best means would be to nationalise Bitcoin mining operations, to ensure that mining rewards henceforth accrue as a majority to the US. This however, places it firmly within government control, erasing Bitcoin’s ethos as a decentralised currency that is free from government intervention.

As such, rather than technicals, we believe investors should continue to monitor Bitcoin’s fundamentals for its merits. We have previously investigated its strong correlations with global money supply (refer to CIO Perspectives article titled “The Value in Bitcoin Volatility”, published 4 Oct 2024) – so the time-tested catalysts of rising liquidity, be it through (a) Fed QE, or (b) tax cuts, are worth monitoring for those looking for a reliable signal.

A quick note on Ethereum. Many have wondered if Ethereum could be a catch-up play to the exceptional performance of Bitcoin in 2024. Alts have after all been the wave that followed Bitcoin’s halving event in prior cycles. We believe that the demand for Ethereum is very much related to demand for DeFi (decentralised finance) related activity (NFT trading, swaps, yield farming etc.) which has been on the decline. These were all the rage in 2021 – seeing as blockchain technology was the best thing since sliced bread back then. The dawn of Artificial Intelligence (AI) however, has drawn the attention of venture capitalists, leaving much less funding for innovation in DeFi in the years since. Unless DeFi activity picks up again, we believe that preference for Bitcoin would remain as the “safe haven” cryptocurrency.

The easy money has been made. The catalysts for cryptocurrency in 2024 were quite unique, seeing the confluence of rising demand and falling supply (refer to CIO Perspectives article titled “Approaching the Bitcoin Halving Cycle”, published 5 Jan 2024) creating a favourable set up for Bitcoin that is difficult to repeat. 2025 tells a different story, seeing as the catalysts are neither as predictable nor dependable. As such, we believe investors should remain disciplined, paying attention to more fundamental tailwinds related to liquidity and money supply in decision making, rather than headlines on policy and hype.

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")

Related Insights

- Korea Equities: Growth, Reform, and Resilience12 Dec 2025

- Korea Equities: Growth, Reform, and Resilience12 Dec 2025

- US Equities 1Q26 | The Return to Quality11 Dec 2025

Related Insights

- Korea Equities: Growth, Reform, and Resilience12 Dec 2025

- Korea Equities: Growth, Reform, and Resilience12 Dec 2025

- US Equities 1Q26 | The Return to Quality11 Dec 2025