- Trump’s tariff-driven uncertainties have reduced growth expectations but raised inflation concerns

- TIPS is a niche bond instrument that thrives in such an outcome

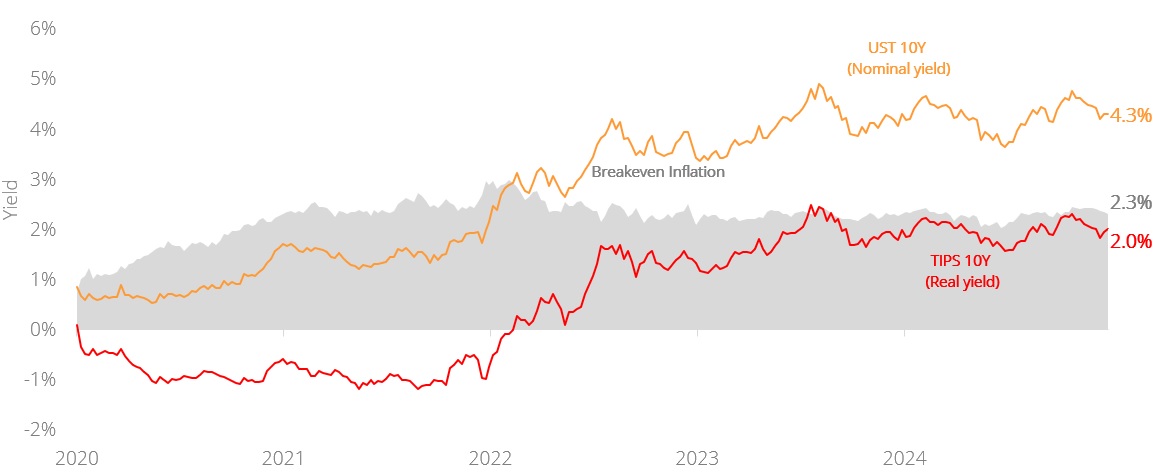

- TIPS real yields likely plateaued as the Fed began cutting rates; Further cuts to act as tailwind

- TIPS' upside is their index ratio that adjusts principal and coupon upwards in line with higher CPI

- We think that long-duration TIPS are attractive given the steep real yield curve

Related Insights

- Implications of the Venezuela Conflict 08 Jan 2026

- Rare Earths: From Scarcity to Strategic07 Jan 2026

- Singapore Equities: Strong Finish, Solid Start06 Jan 2026

New world disorder. The days of late cannot go by without some form of geopolitical or economic shock occupying the headlines. It is a rude awakening for the capital markets, which had initially cheered the perpetuation of American exceptionalism under President Trump’s second act in office. His barrage of tariffs and taunting of traditional US allies, however, have brought sentiment down to the doldrums – as growth is expected to be tepid in a world of uncertainty, while inflation remains sticky as tariff pains begin to bite.

Feeling TIPSy. That is not to say, however, that investors must sit idly by and watch their portfolios get decimated by volatility. In a niche corner of the bond markets lies an instrument that precisely caters for such uncertainty – one that does especially well in an environment of stagnant growth and higher inflation – and that is Treasury Inflation‑Protected Securities (TIPS). A brief explanation of its mechanism is helpful before we dive into the strategy proper.

TIPS did not protect against the inflation spike of 2022. This would not be the first time that we have opined on this instrument. In anticipation of higher inflation, investors were quite keen to explore TIPS at the end of 2021 in what was seemingly a good idea to hedge against a sudden spike in prices. Back then, however, our stance was not one of embrace, but rather caution, seeing that TIPS (real) yields were negative – meaning that prices were already bid up so high that investors were assured negative returns from the pull to par effect (without the inflation adjustment of the index ratio). Notwithstanding, TIPS did outperform US treasuries in that same inflationary period, but that outperformance was not good enough to prevent it from clocking negative total returns in 2022 like the rest of the fixed income markets. Investors that favoured TIPS over treasuries had the consolation of a participant who came in second last in a beauty contest – their investment mitigated some losses but was far from living up to its namesake as an inflation protector.

Real yields at a tipping point. The biggest headwind at the time was clearly the Fed’s aggressive rate hiking cycle, pushing real yields up to a 16-year high within a short span of 1.5 years. The difference for TIPS today, we believe, is that real yields have plateaued as the Fed has already begun a rate cutting cycle. Unless the Fed makes a complete u-turn and hikes rates again – which amounts to a calamitous blunder in forward guidance – the biggest headwind for TIPS is largely behind us. Moreover, a slowdown in growth, as several economic indicators seem to be flashing, implies that the Fed may need to bring down the levels of real rates in due time to provide further accommodation to the economy. Such turning points are often the greatest opportunities for nimble investors to capitalise on.

Breakevens have underestimated actual inflation. Why did TIPS outperform nominal treasuries? We compared 5Y breakeven inflation rates against the actual TIPS CPI adjustment 1Y forward and found that breakevens had persistently underestimated the strength and persistence of actual inflation – for more than five years in a row now. Breakeven inflation hardly moved beyond its tight range of 2-3% despite headline CPI soaring to 9% and beyond (recall that nominal yield = real yield + breakeven inflation). Given that the ongoing threat of tit-for-tat tariffs presents upside risks to CPI prints, one could say that 5Y US breakeven inflation rates at around just 2.5% today appear complacent; surely a security with inflation-hedging characteristics can provide the optionality that would be valuable in uncertainty.

Other potential considerations. As an inflation hedge, TIPS yields and gold have had near perfect correlations before 2022. Something drastic had occurred in that year which forced a decoupling of these inflation hedges, – you guessed it – war. As the US unilaterally froze USD300bn in Russian foreign holdings at the start of Moscow's invasion of Ukraine, countries were forced to make distinctions between TIPS and gold – the former is a debt instrument, while the latter was a neutral reserve asset. While we remain positive on gold, our take is that this decoupling cannot diverge forever; eventually the real yields on TIPS become enticing enough versus the yellow metal that pays no interest.

Ultra-long duration TIPS look attractive. For all our caution on duration, TIPS is one instrument that we have a favorable long duration view, given that the TIPS curve is very steep – investors are adequately compensated for going long. Given the level of indebtedness in the US, it makes little sense for debt sustainability if real yields remained positive for the very long term. Also, this is one debt instrument that the US cannot “inflate away”, given that the principal adjusts with inflation. The Trump administration appears to be serious about the issues of debt sustainability (for now), which is a small plus given that TIPS are ultimately backed by the creditworthiness of the US government.

The bond that beats stagflation. Finally, as a reminder, TIPS sit uniquely in the upper left space of the growth-inflation quadrants for fixed income investing as the only security that performs well in stagflation. Yet TIPS, we believe, does not need stagflation to perform well. Just like the most of the fixed income markets, yields today are high enough for decent recurring income – for TIPS, however, more than a hedge for slower growth, mechanisms ensure that the purchasing power of future coupon payments are commensurate with inflation. What’s not to like?

Figure 1: Real yields swung from negative to positive, breakevens remained flat

Source: Bloomberg, DBS

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")

Related Insights

- Implications of the Venezuela Conflict 08 Jan 2026

- Rare Earths: From Scarcity to Strategic07 Jan 2026

- Singapore Equities: Strong Finish, Solid Start06 Jan 2026

Related Insights

- Implications of the Venezuela Conflict 08 Jan 2026

- Rare Earths: From Scarcity to Strategic07 Jan 2026

- Singapore Equities: Strong Finish, Solid Start06 Jan 2026