- Rising yields on 10-year government bonds should enhance recurring investment yields of insurers

- China’s macro economy remains resilient; rolling out of policy stimulus to support market re-rating

- Easing concerns around LGFV, property risks; improved consumption outlook to support premium growth

- Asia-Pacific regional and China insurers are well-positioned to capitalise on long-term growth

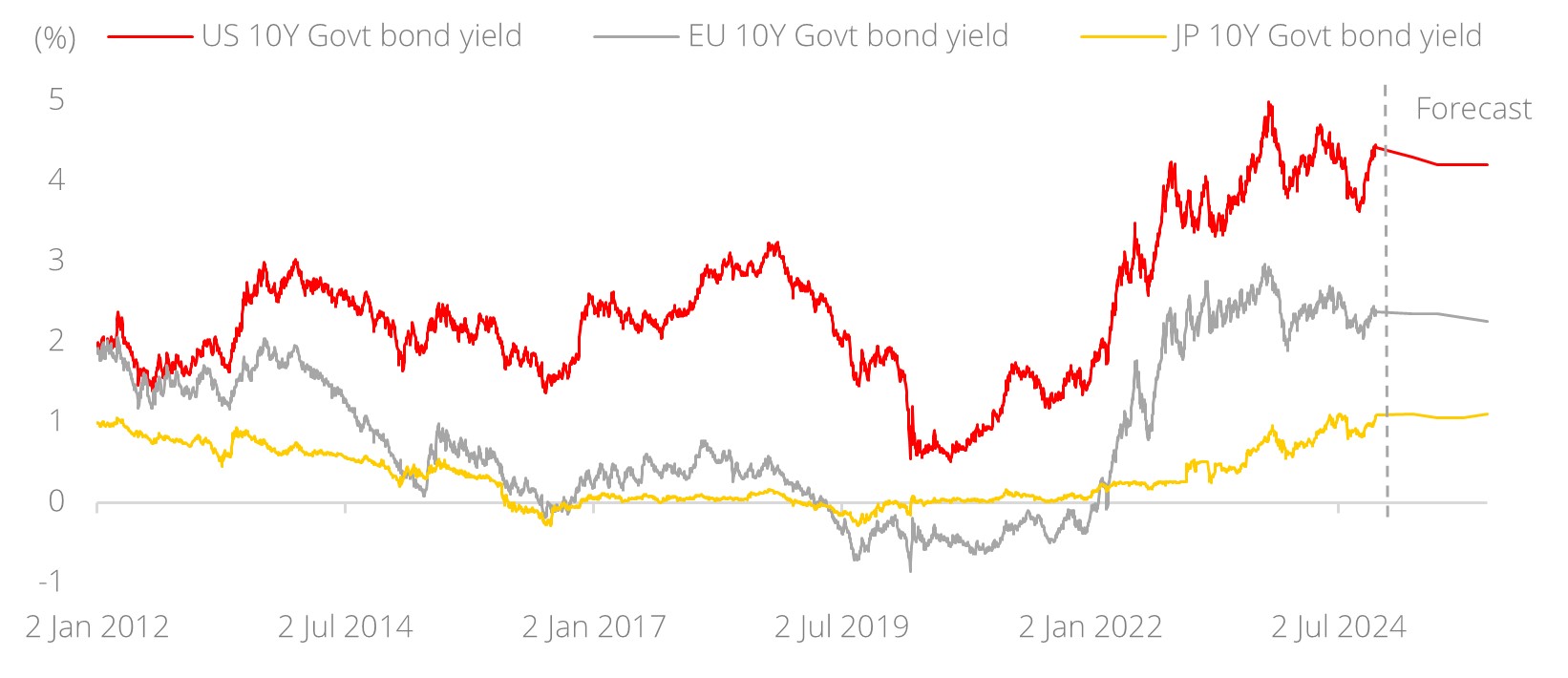

Trump’s presidency favours life insurers. With Donald Trump’s second term in office, we expect rising interest rates and inflation, driven by his aggressive trade policies and increased pressure on European defence spending. These macroeconomic shifts are likely to have mixed implications for global insurers. For life insurers, a higher-for-longer interest rate environment is expected to provide some tailwinds. Rising yields on 10-year government bonds across major markets should support the sale of savings and investment-linked products and enhance recurring investment yields of insurers. Life insurance claims are less sensitive to inflationary pressures as life policies typically have longer durations and more stable claims patterns. Property and casualty (P&C) insurers are likely to face greater challenges due to claim costs which are more exposed to inflationary pressures. This could pressure underwriting margins, particularly if inflation persists at elevated levels.

Eyeing policy stimulus in China. In China, the potential impact of rising tariffs under a second Trump term may be less severe than previously anticipated. While tariffs may increase pressure on China’s export sector, demand from emerging markets and China’s efforts to reduce its trade deficit could help offset the impact. Moreover, the Chinese government’s ongoing policy stimulus measures are expected to provide substantial support to economic growth and market sentiment. The recent announcement of a RMB6bn debt swap plan, aimed at addressing bad debt in local government financing vehicles (LGFVs), is a key step in stabilising the financial system. Additionally, the planned capital injection into major China banks should facilitate loan book expansion, supporting economic activity across both public and private sectors. Combined with consumption-driven stimulus measures, these actions are likely to result in stable economic growth in China. Insurers in China stand to benefit from a reduction in concerns around LGFV and property risks, while an improved consumption outlook should support premium growth, particularly in the life and health insurance segments.

Selective names with robust growth and diversified business portfolio. We continue to favour Asia-Pacific regional and China insurers which are well-positioned to capitalise on secular growth opportunities in the Asia life insurance market. This sector is expected to outpace global peers in terms of growth, driven by favourable demographics and rising middle-class wealth. Additionally, insurers with strong ties to the high-net-worth (HNW) segment in Asia stand to benefit from an increasing customer base and closer connections across China and ASEAN countries. Any upside surprise in China’s policy stimulus could further catalyse a re-rating of regional and China insurers. We also see attractive opportunities in global insurers with strong market positions and a balanced business mix that can pass rising claim costs to customers and maintain strong premium growth. Companies with significant exposure to Asia—particularly those offering attractive shareholder returns (dividend yield >5%, plus share buyback)—remain our top picks in the global insurance space.

Figure 1: US/EU/JP 10-year government bond historical yield and DBS forecasts

Source: Bloomberg, DBS

Download the PDF to read the full report.

Topic

DISCLAIMERS AND IMPORTANT NOTES

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. The information herein does not have regard to the investment objectives, financial situation and particular needs of any specific person. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Companies within the DBS Group or the directors or employees of the DBS Group or persons/entities connected to them may have positions in and may affect transactions in the underlying product(s) mentioned. Companies within the DBS Group may have alliances or other contractual agreements with the provider(s) of the underlying product(s) to market or sell its product(s). Where companies within the DBS Group are the product provider, such company may be receiving fees from the investors. In addition, companies within the DBS Group may also perform or seek to perform broking, investment banking and other banking or financial services to the companies or affiliates mentioned herein.

This publication may include quotation, comments or analysis. Any such quotation, comments or analysis have been prepared on assumptions and parameters that reflect our good faith, judgement or selection and therefore no warranty is given as to its accuracy, completeness or reasonableness. All information, estimates, forecasts and opinions included in this document or orally to you in the discussion constitute our judgement as of the date indicated and may be subject to change without notice. Changes in market conditions or in any assumptions may have material impact on any estimates or opinion stated.

Prices and availability of financial instruments are subject to change without notice. Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results. Future results may not meet our/ your expectations due to a variety of economic, market and other factors.

This publication has not been reviewed or authorised by any regulatory authority in Singapore, Hong Kong, Dubai International Financial Centre, United Kingdom or elsewhere. There is no planned schedule or frequency for updating research publication relating to any issuer.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

The investment product(s) mentioned herein is/are not the only product(s) that is/are aligned with the views stated in the research report(s) and may not be the most preferred or suitable product for you. There are other investment product(s) available in the market which may better suit your investment profile, objectives and financial situation.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

Country Specific Disclaimer

This publication is distributed by DBS Bank Ltd (Company Regn. No. 196800306E) ("DBS") which is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS").

This publication is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) or an “Institutional Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only and may not be passed on or disclosed to any person nor copied or reproduced in any manner.