- Obesity affects c.650mn patients globally

- Weight-loss drugs are spiking in popularity with Wegovy generating USD4.5bn in sales

- Breakthrough in MariTide by Amgen, world’s first biologic weight-loss drug

- Other companies developing biologic weight-loss drugs will benefit as well

Related Insights

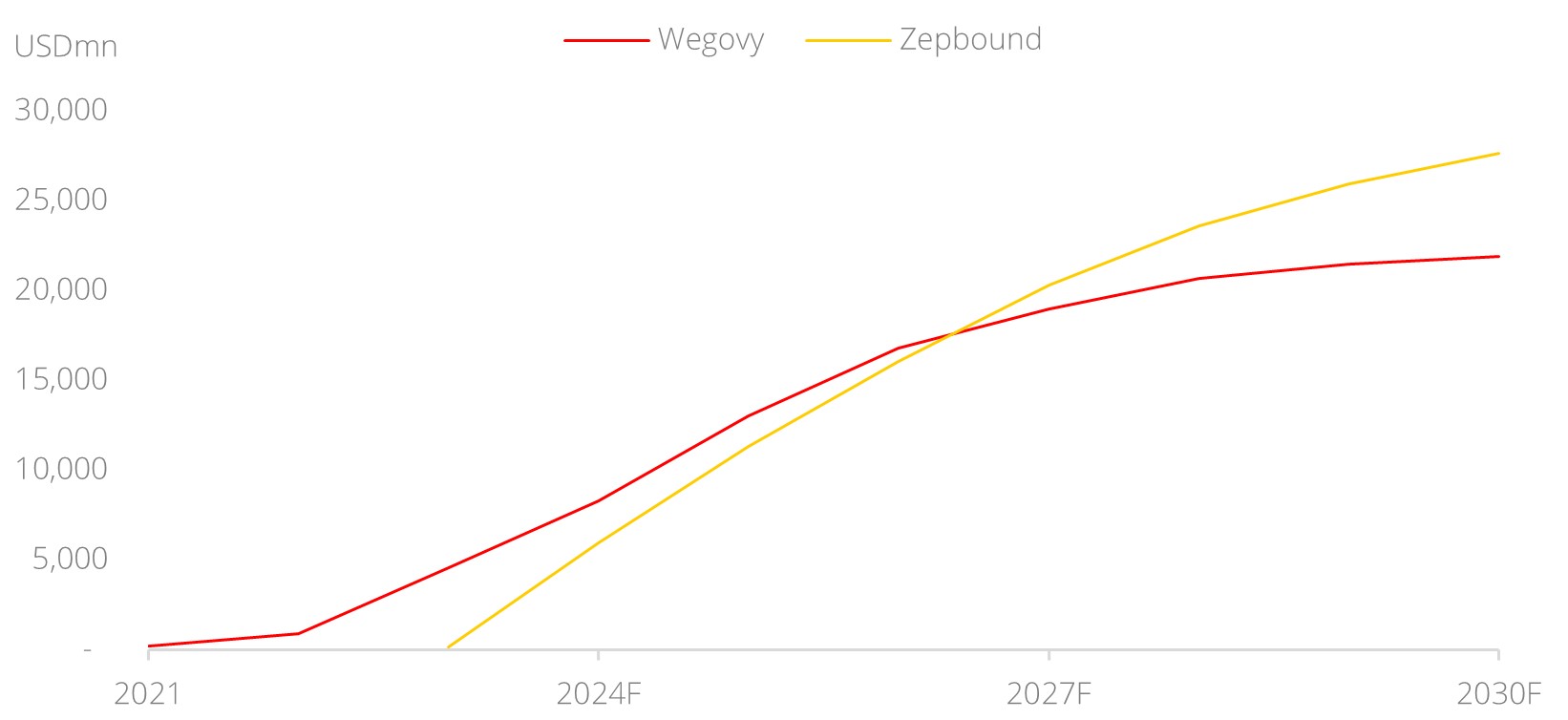

Rise in popularity of weight-loss drugs due to simple usage and high efficacy. Obesity, often defined as having a body mass index (BMI) of over 30, affects c.650mn patients globally. The current weight-loss drug market is a duopoly dominated by Novo Nordisk (NOVOB DC) and Eli Lilly (LLY US). In 2021, Novo Nordisk launched Wegovy, its first glucagon-like peptide-1 (GLP-1) receptor agonist for treatment of obesity. GLP-1 drugs work by activating the GLP-1 receptor which inhibits appetite, effectively leading to weight loss. Wegovy skyrocketed in popularity, generating USD4.5bn in sales in FY23 and is expected to bring in USD13.0bn in FY25F, according to estimates by Visible Alpha. In 2023, Eli Lilly launched Zepbound, its first dual glucose-dependent insulinotropic polypeptide/glucagon-like peptide-1 receptor co-agonist (GIP/GLP-1). GIP/GLP-1 drugs work by blocking the GIP receptor (which leads to less fat storage) and activating the GLP-1 receptor (which inhibits appetite), leading to weight loss. Zepbound brought in USD176mn in FY23 and is expected to bring in USD11.3bn in FY25F, according to estimates by Visible Alpha.

Breakthrough in weight-loss drugs industry. Wegovy and Zepbound are both small-molecule drugs injected weekly, reducing body weight by 14.9% in 68 weeks and 13.6% in 52 weeks, respectively. The breakthrough comes in the form of MariTide by Amgen (AMGN US) which is a large-molecule drug injected monthly, reducing body weight by 14.5% in 12 weeks, significantly sooner than Wegovy and Zepbound. Its molecular size is 31-36x larger than that of Wegovy and Zepbound, which allows it to stay in the human body longer, resulting in less frequent injections. We expected Amgen to start phase 3 clinical trials in early 2025, with interim results expected to be released in 2H25 on indications such as obesity, type 2 diabetes, cardiovascular disease, and chronic kidney disease. The data is expected to be positive, as Amgen has axed R&D of other weight-loss drugs to focus on MariTide.

Other companies developing biologic GLP-1 drugs will benefit as well. Apart from Amgen, Sino Biopharmaceutical is the only company globally developing a biologic weight-loss drug (GMA106) with a formula similar to that of MariTide (GIP/GLP-1). Amgen’s share price surged 12% in one day when it reported positive Phase 2 interim data. Phase 2 clinical data is expected in 4Q24. The positive clinical data of MariTide will raise market confidence in its mechanism which could spill over to the GMA106 drug. Visible Alpha estimates GMA106 will generate sales of USD54-493mn in 2028F-30F, equivalent to 1-13% of 23A sales.

Figure 1: Weight-loss drug sales

Source: Visible Alpha, DBS

Download the PDF to read the full report.

Topic

DISCLAIMERS AND IMPORTANT NOTES

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. The information herein does not have regard to the investment objectives, financial situation and particular needs of any specific person. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Companies within the DBS Group or the directors or employees of the DBS Group or persons/entities connected to them may have positions in and may affect transactions in the underlying product(s) mentioned. Companies within the DBS Group may have alliances or other contractual agreements with the provider(s) of the underlying product(s) to market or sell its product(s). Where companies within the DBS Group are the product provider, such company may be receiving fees from the investors. In addition, companies within the DBS Group may also perform or seek to perform broking, investment banking and other banking or financial services to the companies or affiliates mentioned herein.

This publication may include quotation, comments or analysis. Any such quotation, comments or analysis have been prepared on assumptions and parameters that reflect our good faith, judgement or selection and therefore no warranty is given as to its accuracy, completeness or reasonableness. All information, estimates, forecasts and opinions included in this document or orally to you in the discussion constitute our judgement as of the date indicated and may be subject to change without notice. Changes in market conditions or in any assumptions may have material impact on any estimates or opinion stated.

Prices and availability of financial instruments are subject to change without notice. Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results. Future results may not meet our/ your expectations due to a variety of economic, market and other factors.

This publication has not been reviewed or authorised by any regulatory authority in Singapore, Hong Kong, Dubai International Financial Centre, United Kingdom or elsewhere. There is no planned schedule or frequency for updating research publication relating to any issuer.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

The investment product(s) mentioned herein is/are not the only product(s) that is/are aligned with the views stated in the research report(s) and may not be the most preferred or suitable product for you. There are other investment product(s) available in the market which may better suit your investment profile, objectives and financial situation.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

Country Specific Disclaimer

This publication is distributed by DBS Bank Ltd (Company Regn. No. 196800306E) ("DBS") which is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS").

This publication is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) or an “Institutional Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only and may not be passed on or disclosed to any person nor copied or reproduced in any manner.