- Inflation expectations bottom, but there may be no further disinflation left.

- Market participants have wrongly bet on global/US recession several times.

- Concern on USD assets including US Treasuries is likely a recurring theme.

- Lower Fed rates may not justify outright receive positions and curve steepening for EM/Asia rates.

Related Insights

- Indonesia 2026 Outlook: Time to deliver16 Dec 2025

- FX Quarterly 4Q 25: A Lame Duck USD15 Dec 2025

- India 2026 outlook: Reform and resilience10 Dec 2025

2025 will probably be characterised by significant volatility in the rates space as market participants come to terms with a Trump 2.0 World. It will still be several more weeks before Trump gets inaugurated on 20 January. The sequencing and magnitude of the changes he intends to enact would have different impact on global rates. Between tax cuts and tariffs, there is plenty for investors to chew on. Moreover, there would be nuances as to how different central banks adjust to these new impulses. Below, we discuss some of the relevant themes that will be in play this year.

Trump risks embed into rates

Inflation expectations bottom – Inflation has cooled off significantly across much of the DM space. This is the pretext for central banks to lower interest rates. However, we note that base effects would no longer be favourable going forward and there is sticky inflation to consider. Moreover, the prospect of further tariffs and other trade frictions could well return in 2025, perhaps more so with Trump back at the helm. In the absence of a recession, the risks to breakevens may be to the upside.

Resilient growth outlook – Market participants have wrongly bet on a global / US recession several times over the past few years. In each instance, the global economy, excluding China, has proven to be surprisingly resilient despite elevated interest rates. The US is not showing signs of slowing. Moreover, there are perceived upside growth risks with Trump’s victory. More corporate tax cuts may be in the offing. We also note that the Chinese economy may make a cyclical turn in 2025 if the fiscal stimuli prove to be successful. The rise in term premium in the UST curve reflects an improved growth outlook. However, at current levels, as markets factored in the Red Sweep, we think a fair amount of optimism may already be in the price.

Bond vigilantes lurk – Concern on USD assets including US Treasuries is likely to be a recurring theme. There appears to be no political will to fix the US budget position and the fiscal deficit would likely run at 5-6% of GDP even if the economy stays strong. The bias to the deficit is probably tilted wider with Trump back as President. Confidence in USD assets could erode on wide fiscal deficits and / or any kind of threat to central bank independence. We also note that de-dollarization may be a critical theme as asset managers diversify holdings to avoid getting caught if the USD gets weaponised. Investors may well demand a larger yield premium to hold USTs if the USD starts losing some of its allure as a store of value. Implied real 10Y yields of 2-2.5% would probably pass for investor expectations of a firm US economy. However, if the implied 10Y real yield widens beyond 2.5%, it could well signal investor unease over the sustainability of the US’s fiscal position. Manifestation of fiscal stress is not confined to higher nominal / real yields. We note that the UST-Swap spread (SOFR less yield) has turned even more inverted over the past few months. Similarly in the Eurozone, worries about increased Bund issuances have flipped the Bund-swap (yield less ESTRON) negative. For an extended period, this spread was positive amidst the shortage of Bunds. Taken together, we wary of ultra-long tenor govvies (>10Y) as bond vigilantes could step in to check excessive fiscal looseness.

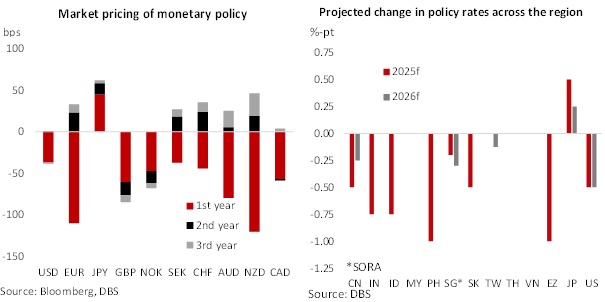

Policy normalisation will get complicated as Trump introduces new policies. For much of the G10, normalisation means lower policy rates. Seven out of ten have already cut rates in 2024 and further cuts are likely forth coming given that policy settings are still restrictive. That said, the pressure to cut differs for each central bank. Right now, the BOC, RBNZ and the ECB appear to have the most compelling cases for an extended easing cycle heading well into 2025. If Trump introduces more protectionist measures, some DM central banks may be biased to be even more dovish. However, that is not the case for the Fed as US data proved surprisingly resilient. The risk is that the Fed would ultimately deliver a shallower cut cycle than currently anticipated. On the other end of the spectrum, normalisation means higher rates for the BOJ. Although political uncertainties (the LDP coalition has lost its majority) would mean that the BOJ is biased to be more cautious, we note that excessive yen weakness would still prompt the BOJ to react. BOJ rate hikes could well spill over into 2026. Accordingly, we see modest curve steepening across DM curves as the short end (<3 years) gets anchored by still dovish central banks.

EM/Asia rates: Tug-of-war between slower growth and external uncertainty

For EM / Asia rates, the much-awaited respite from lower Fed rates may not be enough to justify outright receive positions. Our relative value monitor indicates that Asia local currency govvies are still facing considerable headwinds even as Fed easing is now well underway. Between a firm USD (thus far) and higher USD rates as Fed easing bets get pared (and US equities still buoyant), the environment is still challenging. To be sure, some central banks (Indonesia, Korea, Philippines) have begun easing, providing a bit of tailwind to LCY govvies. China, meanwhile, has also embarked on more rate and RRR cuts to support the economy. However, the external environment may constraint how far Asia central banks can ease with Asia FX weakness seen since the start of the Fed cut cycle, which was also when the market started pricing in Trump’s policies and a resilient US economy. In the end, there is a conflict of domestic and external priorities for Asia central banks. Receive positions would be more apparent for economies where:

-growth is clearly stalling and there is a need to support the economy;

-inflation is cooling, keeping real rates high;

-currency weakness is not apparent;

-less susceptibility to tariff announcements and the subsequent risk-off reaction. Arguably, this means that less export-oriented economies may see less volatile price action.

Trades for 2025 have to be a lot more opportunistic. Alternatively, spread plays may be a better way to express views without taking a level view of rates. Below, we lay out some of our high conviction ideas.

To read the full report, click here to Download the PDF.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- Indonesia 2026 Outlook: Time to deliver16 Dec 2025

- FX Quarterly 4Q 25: A Lame Duck USD15 Dec 2025

- India 2026 outlook: Reform and resilience10 Dec 2025

Related Insights

- Indonesia 2026 Outlook: Time to deliver16 Dec 2025

- FX Quarterly 4Q 25: A Lame Duck USD15 Dec 2025

- India 2026 outlook: Reform and resilience10 Dec 2025