- A rebalancing of the economic system would require a rebalance of assets.

- Trump’s tariffs and associated uncertainties have increased urgency amongst investors to reduce USD.

- This rebalancing would likely take time amidst considerable constraints.

- USTs could trade like a risky asset until rebalancing is done.

- Asia rates may decouple from USD rates.

Related Insights

- China: Strong 1Q, cloudy outlook17 Apr 2025

- Research Library17 Apr 2025

- Global Credit Pulse: Reverberations from tariffs10 Apr 2025

A rethink / rebalancing of the global monetary regime is underway. The existing global economic system had worked well for decades. This system can be traced back to 1971 when the USD was de-pegged from gold. Even through the stagflation period of the 1970s and the erosion of US economic clout in relative terms in the ensuing decades, the USD was the reserve currency of choice. The role of the USD took a serious hit in the Global Financial Crisis (GFC) of 2008/09 and that triggered the creation of crypto currencies. However, even as confidence in the US got dented, crises in the Eurozone (2011) and China (2015/16) meant that there is no alternative to the USD. That has since changed. As China’s economic clout grew and Trump seeks to rework the global economic system (tariff wars), the global financial system must also be rejigged. Below, we lay out some of the considerations from an interest rates perspective for the medium term.

How are reserves going to be rebalanced?

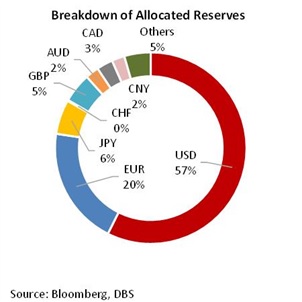

There are good reasons for diversifying reserves away from the USD (USD make up some 57% of global FX reserves). For some economies, fear of the USD being weaponized is the key cause. For others, recent actions from the US (especially from the tariff policies) have eroded the confidence of investors in USD assets. The upshot is that many investors are probably thinking about reallocation if they are not already in the midst of doing so.

That said, there are constraints. Reserves should be put in assets which can retain value (store of value) and they must also be in large / liquid markets. US Treasuries fit the bill. Up until recently, USTs have been the go-to asset during times of risk aversion and investors generally had confidence in the US economy and its institutions. Size wise, there are some USD 26tn of USTs outstanding. Comparatively, there are about USD 10tn in European general government securities, USD 9tn in JGBs and USD 10.5tn in China government securities outstanding. Simplistically, just considering these four blocs, USD reserves should only make up about 46% of total FX reserves. However, in reality, the amount of debt available for the public to buy is even more constrained. Importantly, only the US runs a large current account deficit. By the balance of payments identity, this means that there will be a lot of USTs left for the rest of the world to purchase. Comparatively, if an economy runs a balanced or surplus current account, government debt can easily be absorbed by their respective domestic sectors. Note that this dynamic did not even take into account that fact that the Fed, ECB, BOJ and PBoC all hold considerable amounts of government bonds. Constraints on eligible assets for reserves are binding for the short term and could be the key reason why gold has been outperforming. There have been 200k tons of gold mined thus far and this amounts to about USD 21tn at current gold prices. However, not all of that gold is tradable in the financial markets.

Given time, the constraints could ease but that would probably require the Eurozone and China to step up domestic demand with their respective governments leading the charge. We have seen some encouraging signs of Europe willing to raise infrastructure and defence spending. Similarly, the Chinese authorities are stepping up on fiscal stimulus amidst intense economic and trade war pressures. These dynamics would likely require an extended period to play out. Accordingly, an optimal reallocation of reserves will likely not be possible for several years.

To read the full report, click here to Download the PDF.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- China: Strong 1Q, cloudy outlook17 Apr 2025

- Research Library17 Apr 2025

- Global Credit Pulse: Reverberations from tariffs10 Apr 2025

Related Insights

- China: Strong 1Q, cloudy outlook17 Apr 2025

- Research Library17 Apr 2025

- Global Credit Pulse: Reverberations from tariffs10 Apr 2025