Related Insights

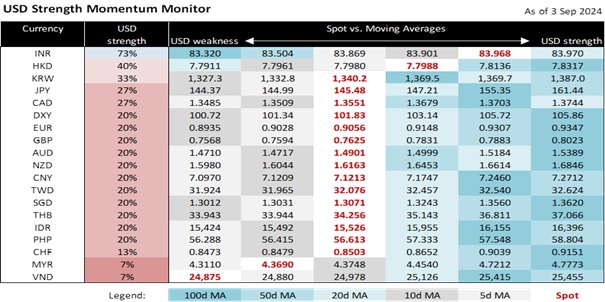

US financial markets reopened after the Labor Day holiday, facing concerns over another unwinding of yen carry trades ahead of Friday’s US monthly jobs report. Following the market’s adverse reaction to the FOMC and BOJ meetings on July 31, investors are cautious about the BOJ meeting on September 20, just two days after the Fed is expected to deliver its first rate cut. The JPY appreciated by 1% overnight, while AUD, NZD, and GBP depreciated by 1.2%, 0.7%, and 0.3%, respectively. The yen’s strength was driven by a document submitted by Bank of Japan Governor Kazuo Ueda to Japanese lawmakers, which reaffirmed the commitment to keep raising interest rates if the Japanese economy meets the central bank’s economic forecasts through FY2025. Ueda attributed the market volatility in July-August to US recession fears, spurred by a rising unemployment rate.

The Fed flagged the primary goal of its telegraphed rate cut as preventing a further weakening in the US labour market. As a result, markets should be vulnerable to today’s US JOLTS report, with consensus expecting job openings to decline to 8100k in July from 8184k in June. On Friday, expectations are for US nonfarm payrolls to stay below 200k and the unemployment rate to above 4% in August, supporting the Fed’s preference for a 25 bps cut. US disinflation expectations also lowered the US Treasury 10Y bond yield by 7.3 bps to 3.83%, more than the 5.4 bps decline in the 2Y yield to 3.86%. New research from the San Francisco Fed projected shelter inflation, the most significant contributor to US inflation, to continue declining to as low as 2% by the end of 2024 before returning to the pre-pandemic average of 3.3% by spring 2025. Markets are assessing how far bond yields can fall, particularly in light of San Francisco Fed President Mary Daly’s estimate of an inflation-adjusted neutral interest rate as high as 1%.

US equities returned from the US Labour Day holiday with their worst sell-off since August 5. The Dow, S&P 500, and Nasdaq Composite Indices fell by 1.5%. 2.2%, and 3.3%, respectively. S&P closed at 5529, below the 5560-5650 range it had traded for the previous ten sessions. Tech sector worries dragged the Nasdaq beneath 17500 for the first time since August 14. Adding to the caution, the US ISM Manufacturing PMI index missed expectations with an increase to 47.2 in August, below the 47.5 consensus. Although the factory index improved from 46.8 in July, it held below the breakeven 50 level for a fifth month. Notably, new orders declined to 44.6, its weakest level since May 2023, dragging the production index to 44.8, its lowest since May 2020. Tomorrow’s ISM Services PMI matters more to the US economy and is expected to moderate slightly to 51.2 from 51.4, supporting a soft landing outlook.

Quote of the day

”Words which do not give the light of Christ increase the darkness.”

Mother Teresa

September 4 in history

In 2016, Pope Francis declared Mother Teresa of Calcutta a saint of the Roman Catholic Church.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.