US equities tumbled again, unable to shake off US job worries and dragging the USD and US bond yields lower. US ADP Employment fell to 99k in August, well below the 145k expected, while July was revised to 111k from 122k. Despite some relief over initial jobless claims declining to 227k for the week ending August 31 from 232k the previous week, ISM service employment dropped to 50.2 in August from 51.1 in July. The futures market held on to their bets for a larger 50 bps cut at the FOMC meeting on September 18 vs. the consensus for a normal 25 bps cut on the Fed’s guidance to prevent a further cooling in the US labour market. Next week’s CPI inflation is also expected to slow to 2.6% YoY in August from 2.9% in July, even as core inflation stays unchanged at 3.2%, both still above the 2% target. The ISM Services PMI survey supported a soft landing in the US economy. Although the headline activity index declined to 50.2 in August from 51.1 in July, it held above the breakeven 50 level for a second month on new orders rising to 53.0 from 52.4.

Today’s US nonfarm payrolls are expected to hold below 200k despite expectations for an increase to 165k in August from 114k in July. Likewise, the unemployment rate should hold above 4% despite projections for a moderation to 4.2% from 4.3%. New York Fed President John Williams and Fed Governor Christopher Waller speak after the US jobs databefore the Fed enters its pre-FOMC blackout next week. Williams was one of the two Fed Presidents who voted to reduce the discount lending rate in July, according to last week’s Fed discount minutes.

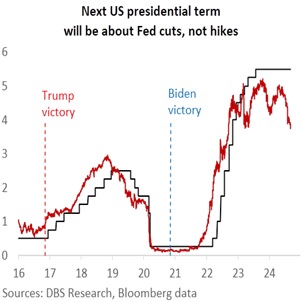

Next week’s focus will be the US Presidential Debate (Sept 11 at 9 am Singapore time). Kamala Harris has supercharged the Democratic campaign and polled ahead of Republican candidate Donald Trump. However, bookmakers have not ruled out a Trump victory. Harris still needs to win over the swing states to secure her legacy as the first female US president. The second debate will be important for voters to assess the divergent approaches of both candidates to their top concerns – the economy and inflation. As far as markets are concerned, the US economy is no longer exceptional, and the next US presidential term will be about the Fed cutting rates and not hikes.

Quote of the day

”Travel teaches us that we have the ability to adapt.”

Ferdinand Magellan

September 6 in history

Ferdinand Magellan’s ship “Victoria” completed the first circumnavigation of the Earth in 1522.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.